Today at the event where Salim Ghauri was speaking and we were all listening to his great journey, a young man during the question answer session asked, Is the Pakistani startup bubble about to burst ? And that sent shivers through my spine, not because of the word bubble but because of the lack of understanding of people of what a “Financial Bubble” in actuality is.

A bubble has a process of creation from stage A to Stage Z. Anything after the stage Z is a bubble. Let me explain. The word bubble is used in financial terms when the price of an asset reaches exorbitantly high levels and valuations go out of reach of a common man’s affordability. That causes the previous buyers difficulty in offloading their assets. And when they can not find a buyer as easily as previously, concerns seep in and panic starts to build. Rumors fly high and eventually shareholders of those assets begin to offload their shares in a rush. That causes a chain reaction and prices start to tumble. But one thing i did not mention here is that it happens only after those private assets have been listed onto stock exchanges in forms of shares for general public to buy. Once the the shares have exchanged hands from astute institutional investors to common rumor loving general public with a lot of greed and a little understanding of what they have bought, this process begins.

Now in light of this above scenario. Lets examine the Pakistani startup “Bubble”. The startups have not even had a start yet what to speak of a bubble. We are not even in our infancy stages. We have barely come to stage “A” and worries are being expressed about stage “Z“. There is not a single startup in Pakistan which has ever been listed onto a stock exchange. We do not have a single startup which is declared a unicorn. We do not even have Equity Funds that invest in start ups. There are no funds, forget about a liquidity crunch in the PE and Listed dealings.

Until the time comes that there are 100 PE funds and all become vested. Until a time comes when billions of dollars a year are coming into our startup companies and several billion dollars worth of valuations are being listed onto our stock exchanges. Until the time comes when the same startup idea is being replicated and being also getting funding at even a higher valuation. Until the time comes when a Dotcom like www.America.com domain alone sells for $36 million dollars in 1990s. Until the time comes when startups after being listed on the exchanges trade at multiples of 5000+ and no earnings for 5 years in a row. Until the time comes where people are selling there homes and cars or taking out loans to buy shares on the exchange in a newly listed startup. Until the time comes when you see 3 startups being listed a month on Pakistan Stock Exchange…..Until all this and much more happens….I have a piece advice for the Youth of Pakistan…

Forge ahead. Stay focused. Start startups like your life depends on it. Remain positive. And give it your 1 billion percent. There is nothing to worry about. We are decades away from a bubble. Yes decades. Do not listen to anyone who is negative and discourages you without facts. Instead of worrying about a bubble, worry about the quality of your idea being started up. In Pakistan we will not have a bubble but we sure can have a series of so many bad ideas seeking funding repeatedly that the investors finally decide that us Pakistanis have no genuine ideas…

So worry about that instead of a bubble.

This is guest article by Mir Muhammad Ali Khan.

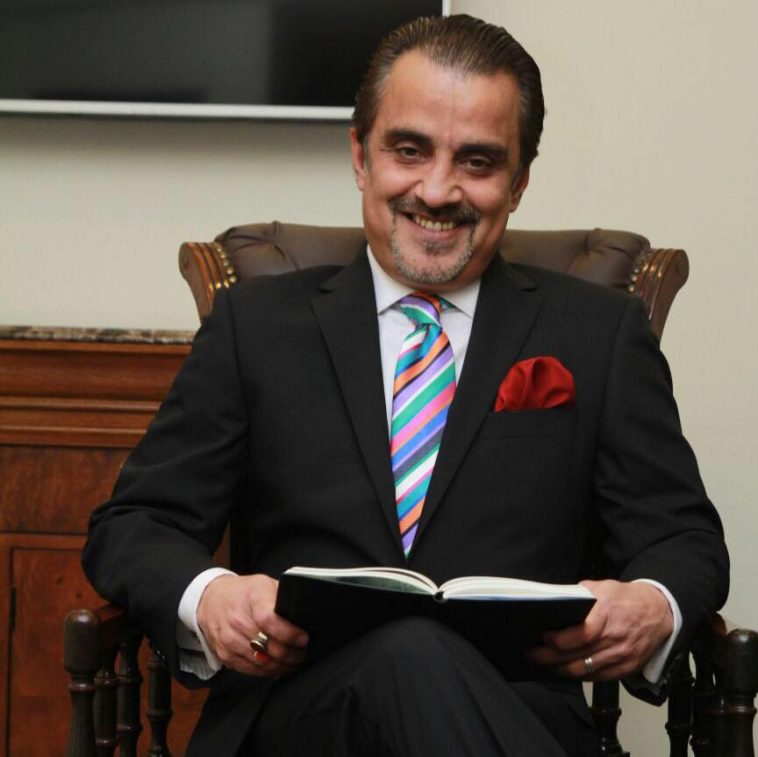

Mir Mohammad Alikhan is internationally renowned Investment Banker, Entrepreneur & Capital Markets Advisor. At the age of 29, he became the youngest Chairman and Founder of a Full service Investment Bank in America and the first Muslim to have owned an investment bank on Wall Street. He has had a successful career as Founder & Chairman The Financial Group, Inc., Federal Advisor to Govt. of Pakistan, a Member of New Jersey Governors Council, a Senior Advisor to New Jersey State Mayors and US State Senators. He introduced Islamic Banking Research into mainstream America by co-sponsoring and advising Harvard University to launch Harvard Islamic Finance and Information Program (HIFIP).

He also developed “THE WORD’S FIRST ISLAMIC BANKING BENCHMARK INDEX on WALL STREET Named:KMS-SAMI: (Socially Aware Muslin Index) Which Is Now A Functional Index Run By The Dow Jones Indices. He has also been featured in “Who’s Who of Top Executives in the World”. Featured in “Humans Of Pakistan” and in 2015 he became the first Pakistani ever to have a movie produced on his life through a first time co-production of Hollywood and Pakistani production house Sermad Films, The Producers of the movie “JALAIBEE”.WWW.MIRMAK.NET/Biography