Introduction: The Market’s Sentiment and Gig Economy’s Rise

The stock market faced early morning declines on Thursday, reflecting investors’ nervousness about the economy’s immediate future. Despite this, two companies specializing in gig work, Upwork and Fiverr, have shown impressive performance. As the gig economy gains acceptance, its stocks continue to rise, offering promising opportunities in the global workplace.

Upwork’s Leap with AI

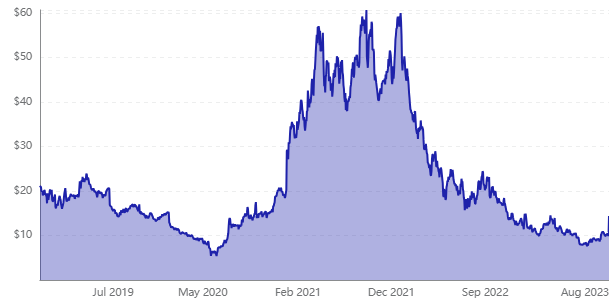

Upwork, the freelance marketplace provider, experienced a significant 16% surge in premarket trading on Thursday. Their second-quarter financial results highlighted positive trends, suggesting a rebounding business.

Revenue for the quarter reached $169 million, a 7% year-over-year increase. Notably, Upwork managed to narrow net losses to $4 million and achieve positive adjusted pre-tax operating earnings. This improvement was attributed to cost-saving actions taken during a period of challenging macroeconomic conditions.

Investors are especially pleased with Upwork’s focus on the expertise of its gig workers in artificial intelligence (AI) and machine learning. The recent partnership with OpenAI enhances Upwork’s credibility, attracting businesses seeking assistance with AI projects, including specialties in large language models, prompt engineering, and productivity-enhancing skills.

While near-term pressures might impede rapid growth, there’s optimism that the demand for specialized support in key areas will fuel Upwork’s marketplace in the long run.

Leveraging AI: Fiverr’s Strategy

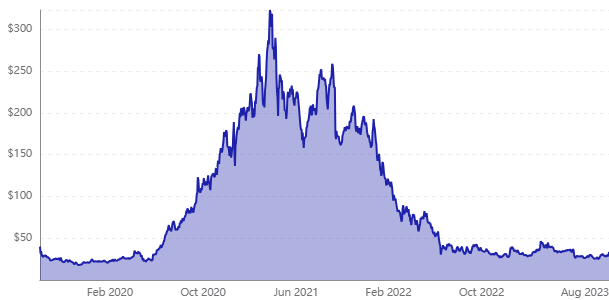

Fiverr International’s stock also saw a notable 5% gain in premarket trading on Thursday. The freelance platform provider’s second-quarter metrics demonstrated modest growth.

Revenue of $89.4 million showed a 5% year-over-year increase, and the number of active buyers remained steady at 4.2 million. Fiverr managed to improve take rates by nearly one percentage point, reaching 30.7%. Moreover, the company achieved a modest profit of $200,000 and adjusted pre-tax operating earnings of $15.3 million.

Fiverr’s innovative use of AI through its Fiverr Neo has been instrumental in matching employers with gig workers for mutually beneficial relationships. Powered by advanced technologies in neural networking, machine learning, and large language models, Fiverr Neo aims to provide the perfect match for clients.

Contrary to worries that artificial intelligence (AI) would eliminate the need for human workers, Fiverr sees AI as an opportunity. When seen from this angle, the company’s stock, which has not yet risen to all-time highs, is expected to do well.

Embracing the Future: Growth Prospects for Upwork and Fiverr

Both Upwork and Fiverr are well-positioned to capitalize on the growth of the gig economy. While their stocks currently fall short of their record levels, the potential for future expansion looks promising.

Upwork’s marketplace has been successfully emphasizing AI and machine learning expertise among its gig workers. This strategic focus, coupled with the recent partnership with OpenAI, is expected to attract more businesses seeking specialized AI support.

Fiverr’s use of AI through Fiverr Neo has the potential to strengthen its position in matching employers and gig workers. By leveraging advanced AI technologies, Fiverr can offer tailored solutions that cater to clients’ needs effectively.

Conclusion:

Despite the broader market fluctuations, the freelance revolution is indeed alive and well, driven by companies like Upwork and Fiverr. Their dedication to AI-related capabilities places them in a favorable position to thrive in the evolving gig economy landscape. Investors looking for opportunities in this growing sector should keep a close eye on these two stocks.