Pandemic has fueled freelance growth. It’s a rise of a trillion-dollar workforce in the world.

The Federal Board Of Revenue (FBR) is planning to impose TAX on freelancers. In the news, it was revealed yesterday that Government wants to withdraw Tax exemption facility given to foreign IT exports.

The news has sparked a huge debate on social media, especially among freelancers. The way this news was expressed by one of the leading news channels is very disappointing.

Are freelancers terrorists?. I strongly condemn the selection of the words by one of the mainstream news channels.

Freelancing is the fastest growing sector. Currently, in Pakistan — freelancers are scaling up and building companies. Many freelancers plan to build their own company in the near future orchestrating ways to provide more jobs and empower more people in society.

Freelancing is experiencing its very early days. It is one of the fastest-growing sectors that need benefits, extra care so more people can be trained, included in the system. Freelancers could potentially bring in millions of dollars in the next couple of years that would further strengthen the economy.

Current Scenario:

Currently, the annual IT exports from Pakistani freelancers are around US$200 million with a 40% growth expected each year. This is a huge step-up in demand from yesteryears, courtesy programs such as DigiSkills, eRozgar, and many mentors, YouTubers raising awareness about freelancing and its benefits.

Freelancers are not harmful by any stretch of the imagination. They do not have any carbon footprint on the economy. They usually work from home and do not commute to work. This brings foreign revenue to the country that not only creates and improves the ecosystem but also plays an instrumental role in improving the country’s economy by creating more jobs.

Taxing this highly growing sector with the potential of further growth would mean “two steps forward and one step back“.

The Current Deduction/Taxes:

Freelancers work on different freelance marketplaces and win one-off independent contracts. The marketplaces include but not limited to Upwork, Guru.com, Fiverr, and Freelancer.com predominantly.

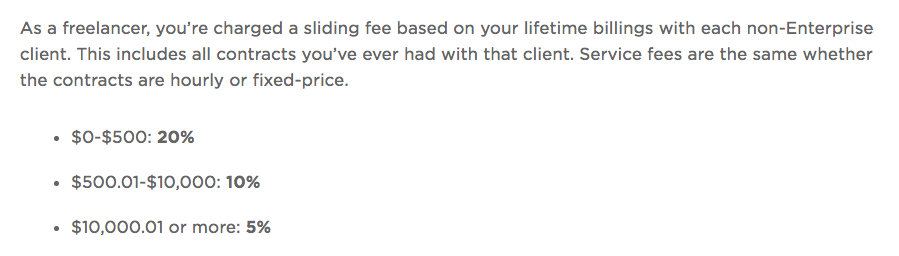

When a freelancer wins a job, the marketplace deducts around 20% or less (depending on the value of a project). Here is a screenshot from Upwork that talks about its deduction fees.

Majority of freelancers in Pakistan win jobs that are less than $500. They pay 20% deduction fees to Upwork and other marketplaces and this is just the tip of the iceberg.

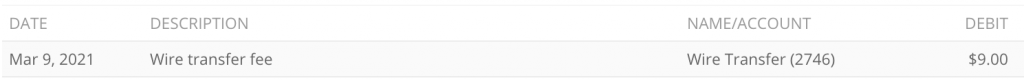

When they withdraw the money they also pay taxes to the banking channel for receiving money in their bank account. A person winning a $500 project on Upwork typically gets around $425 in their pocket after paying Upwork transaction fees, wire transfer fees, and then bank fees in Pakistan.

It must be brought to attention here that all other freelance marketplaces deduct different fees depending on their structure and portal policy. For example on Guru.com, when you withdraw money of US$100, the freelancer pays flat $9 fees for wire transfer. This is in addition to the transaction fees they already pay to the portal for winning a job and getting paid for a project.

Freelancing is gaining huge momentum in the country. Taxing this small but important workforce of tomorrow will kill momentum and also discourage new freelancers to join this field.

If we allow freelancing to nourish with the existing Tax exemption law of 2025, we can not only create more jobs in the country but also bring in huge foreign remittances resulting in strengthening of our economy and build progressive Pakistan.

Truth be told: This is going to be the biggest sector in the near future if properly looked after.

You don’t kill your CASH COW