Pakistan’s e-commerce sector has reached a remarkable milestone, achieving $10.42 billion in market value in 2025, according to the Asian Development Bank’s comprehensive report titled “Pakistan’s Digital Ecosystem: A Diagnostic Report.” This represents a substantial leap from the $7.7 billion recorded in 2024, marking the country’s emergence as a significant player in the global digital economy.

Market Growth and Future Projections

The Asian Development Bank’s findings reveal an impressive growth trajectory for Pakistan’s digital commerce sector. With a projected compound annual growth rate (CAGR) of 17%, the market is expected to reach $12 billion by 2027. This growth significantly outpaces many regional economies and positions Pakistan as one of the fastest-growing e-commerce markets in South Asia.

The retail e-commerce segment, which represents the core of online shopping activities, contributed $5.4 billion to the total market value in 2024. Electronics emerged as the dominant category, accounting for 24% of total e-commerce revenue, followed by fashion, beauty products, and luxury items. Interestingly, online airline ticket bookings generated approximately $2.3 billion annually, making it the second-largest segment and highlighting the growing digitization of travel services.

The retail e-commerce segment, which represents the core of online shopping activities, contributed $5.4 billion to the total market value in 2024. Electronics emerged as the dominant category, accounting for 24% of total e-commerce revenue, followed by fashion, beauty products, and luxury items. Interestingly, online airline ticket bookings generated approximately $2.3 billion annually, making it the second-largest segment and highlighting the growing digitization of travel services.

Read More: How to start an E-Commerce Business in Pakistan in 2024?

Mobile Commerce Revolution

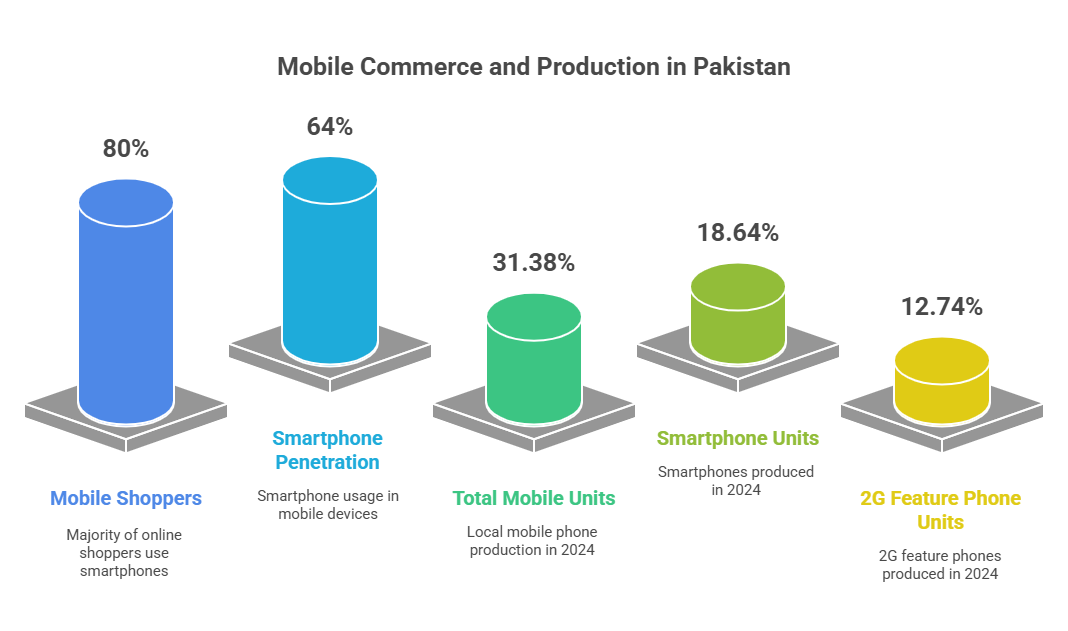

Pakistan’s e-commerce boom is predominantly driven by mobile commerce, with 80% of online shoppers using smartphones for their purchases. This mobile-first approach reflects the country’s broader digital transformation, where smartphone penetration has reached 64% of all mobile devices on the network, compared to just 56% in 2022.

The country’s mobile phone manufacturing sector has also experienced significant growth, with local production reaching 31.38 million units in 2024, representing a 47% increase from the previous year. Of these, 18.64 million units (59%) were smartphones, while the remaining 12.74 million (41%) were 2G feature phones. This shift toward smartphone production and usage has been instrumental in driving e-commerce adoption across urban and semi-urban areas.

Payment Landscape and Digital Transformation

Despite the digital growth, Pakistan’s e-commerce sector continues to face challenges related to payment preferences. Cash on Delivery (COD) still dominates 93.7% of e-commerce transactions, reflecting lingering consumer skepticism about online payment security. However, the broader digital payments ecosystem is showing remarkable progress, with digital payments growing by 35% in FY24 and accounting for 84% of all retail transactions by volume.

The State Bank of Pakistan reported that 309 million e-commerce payments were made during FY24, with a total transaction value of PKR 406 billion. Significantly, 87% of e-commerce payments were initiated through bank accounts or digital wallets, indicating a gradual shift away from cash-based transactions.

Mobile banking and e-wallet services have been key drivers of this transformation. The number of mobile banking app users increased by 16%, internet banking users grew by 25%, and e-wallet users surged by an impressive 85% during FY24. This growth is supported by the expanding digital payment infrastructure, with 125,593 Point of Sale (POS) machines now operational across the country, representing an 8.9% increase from the previous year.

Read More: Importance of E-commerce in Pakistan’s economic growth

Infrastructure Challenges and Digital Divide

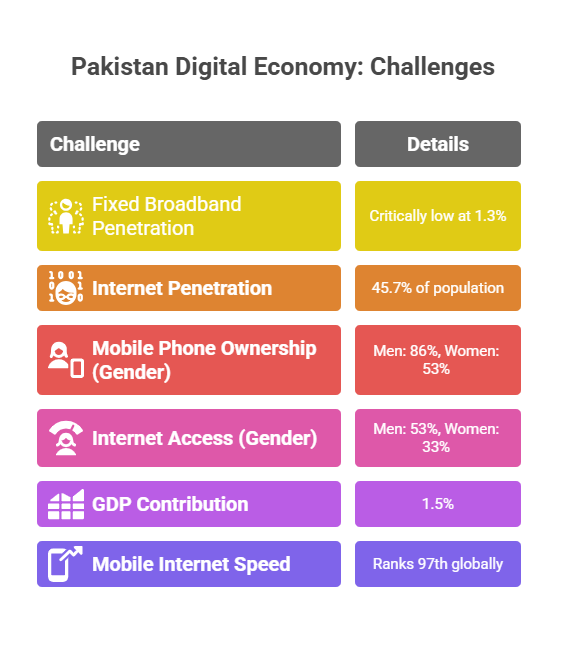

While the growth figures are impressive, the ADB report highlights significant infrastructure gaps that continue to hinder Pakistan’s e-commerce potential. Fixed broadband penetration remains critically low at 1.3% of the population, one of the lowest rates in the region. Internet penetration stands at 45.7% of the total population, with approximately 116 million internet users as of early 2025.

The digital divide is particularly pronounced along gender lines. While 86% of Pakistani men own mobile phones, only 53% of women have mobile phone access. Similarly, 53% of men have internet access compared to just 33% of women. These disparities reflect deep-rooted cultural and economic barriers that limit women’s participation in the digital economy.

The digital divide is particularly pronounced along gender lines. While 86% of Pakistani men own mobile phones, only 53% of women have mobile phone access. Similarly, 53% of men have internet access compared to just 33% of women. These disparities reflect deep-rooted cultural and economic barriers that limit women’s participation in the digital economy.

Pakistan’s digital economy contributes only 1.5% to the country’s GDP, significantly below its potential compared to regional leaders like India and Bangladesh. The country ranks 97th globally in mobile internet speed, creating bottlenecks for businesses trying to scale their online operations.

Small and Medium Enterprise Empowerment

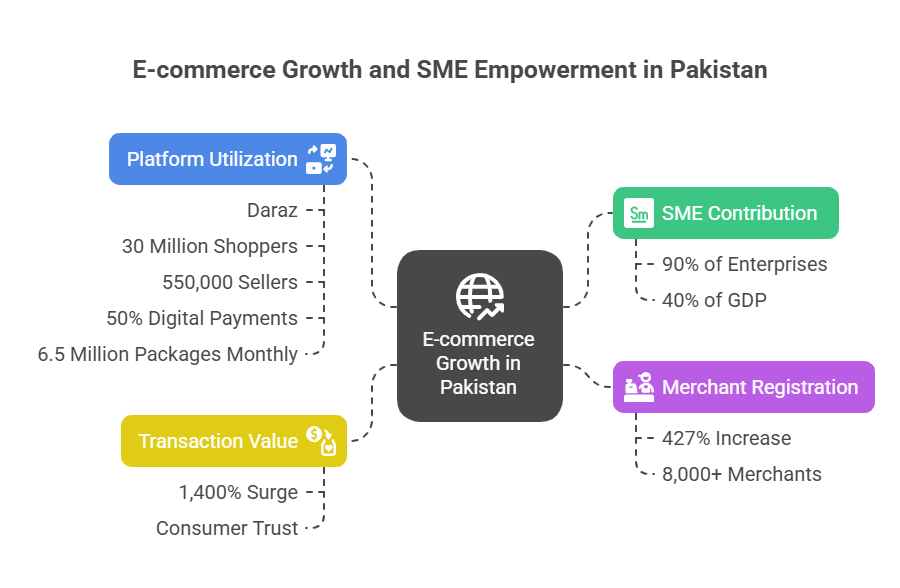

The e-commerce boom presents unprecedented opportunities for Pakistan’s small and medium enterprises (SMEs), which comprise over 90% of all enterprises and contribute approximately 40% to the nation’s GDP. The number of registered e-commerce merchants increased by 427% between 2019 and 2023, demonstrating the sector’s capacity to bring informal businesses into the formal economy.

Over 8,000 merchants have registered with banks and payment providers since the introduction of Pakistan’s first e-commerce policy in 2019, bringing previously informal sellers into the regulated ecosystem. The e-commerce transaction value surged by 1,400% between FY2019 and FY2024, reflecting growing consumer trust and merchant adoption.

Over 8,000 merchants have registered with banks and payment providers since the introduction of Pakistan’s first e-commerce policy in 2019, bringing previously informal sellers into the regulated ecosystem. The e-commerce transaction value surged by 1,400% between FY2019 and FY2024, reflecting growing consumer trust and merchant adoption.

Many SMEs are leveraging platforms like Daraz, which has become the dominant e-commerce marketplace in Pakistan with over 30 million shoppers and 550,000 sellers. The platform facilitates 50% digital payments and ships over 6.5 million packages monthly, providing crucial infrastructure support for smaller businesses.

Read More: Best AI Tools for Pakistani E-Commerce: Features & Pricing

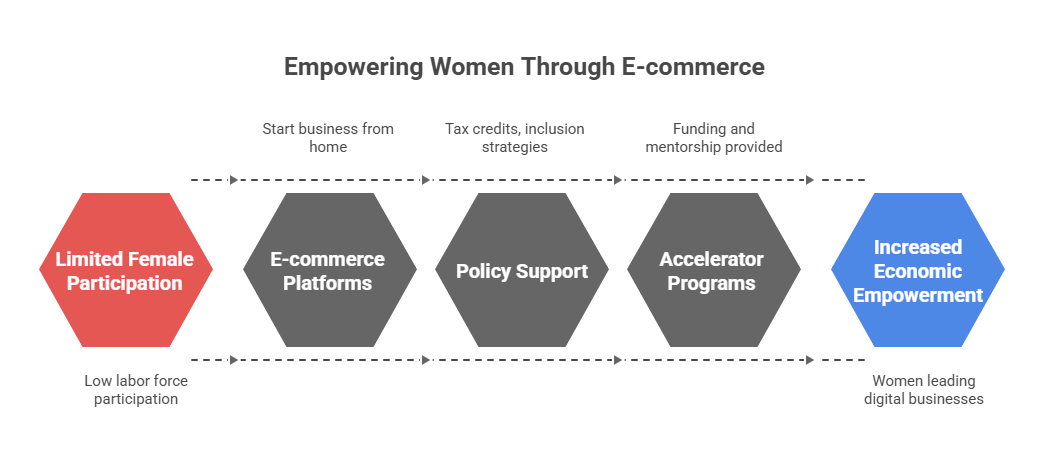

Women Entrepreneurs in the Digital Space

The e-commerce sector is creating new opportunities for women entrepreneurs, despite broader participation challenges. Only 23% of women participate in Pakistan’s labor force, but e-commerce platforms enable women to start businesses from home, overcoming traditional mobility and cultural constraints.

Women-led digital businesses are receiving increasing policy support, with the ADB recommending tax credits for women-led digital businesses and targeted inclusion strategies. Programs like the Women in Tech Accelerator by Standard Chartered Pakistan provide catalytic funding and mentorship, having supported multiple cohorts of female entrepreneurs since 2019.

Women-led digital businesses are receiving increasing policy support, with the ADB recommending tax credits for women-led digital businesses and targeted inclusion strategies. Programs like the Women in Tech Accelerator by Standard Chartered Pakistan provide catalytic funding and mentorship, having supported multiple cohorts of female entrepreneurs since 2019.

Success stories are emerging across the country. For example, Shaheen Ejaz from Quetta built MNM Products, a herbal skincare business that transitioned online and now employs multiple women while serving customers nationwide. Such cases demonstrate the transformative potential of e-commerce for women’s economic empowerment in conservative social environments.

Policy Framework and Government Initiatives

The Pakistani government is actively developing comprehensive policy frameworks to support e-commerce growth. The E-Commerce Policy 2025-30 is currently under consultation, building on the success of the original 2019 policy. The new policy adopts a lifecycle-based approach, offering end-to-end support from business onboarding to cross-border trade facilitation.

Key features of the upcoming policy include:

Key features of the upcoming policy include:

-

Formal inclusion of youth aged 15-18 as active e-commerce participants

-

Establishment of the National E-Commerce Council (NeCC) for coordinated implementation

-

Age-appropriate compliance pathways for young entrepreneurs

-

Enhanced consumer protection mechanisms

-

Streamlined cross-border trade procedures

The government’s Pak e-SME program aims to identify, train, and connect 50,000 e-SMEs from remote areas to online marketplaces. Additionally, the DigiSkills program has trained over 4 million individuals, empowering youth, women, and freelancers with essential digital competencies.

Asian Development Bank Recommendations

The ADB report outlines several critical recommendations to sustain and accelerate Pakistan’s e-commerce growth:

Infrastructure Development

-

Implement a uniform 5% GST on all digital transactions to encourage e-commerce adoption and reduce cash-based inefficiencies

-

Invest heavily in broadband expansion and reliable 4G/5G networks, particularly in rural areas

-

Rationalize all digital infrastructure taxes to make them competitive regionally and fix rates for at least 10 years

Business Environment Reforms

-

Cut corporate income tax rates by 10% for SMEs that register and use digital platforms for the next 10 years

-

Mandate that commercial banks allocate at least 15% of their loan portfolios to SMEs, with 50% emphasis on digital and ICT businesses

-

Cap income tax for ICT export company staff at 15%

Digital Inclusion Initiatives

-

Provide low-cost or installment-based smartphones to improve device accessibility

-

Expand digital literacy programs, particularly targeting women and rural populations

-

Create robust consumer protection laws and establish e-courts for dispute resolution

Regional and Global Context

Pakistan’s e-commerce growth, while impressive, must be viewed in a regional context. India’s e-commerce market is valued at $123 billion, dwarfing Pakistan’s $10.42 billion despite the latter’s strong growth trajectory. However, Pakistan’s 17% CAGR compares favorably with regional averages and positions the country well for continued expansion.

The country ranks 50th globally in e-commerce market size, placing it ahead of Iran and several other regional competitors. With projections suggesting the digital economy could contribute $60-75 billion by 2030, Pakistan has the potential to become a significant regional digital hub.

Read More: How the E-Commerce Industry Is Changing and What Companies Are Doing to Succeed in 2025

Challenges and Barriers

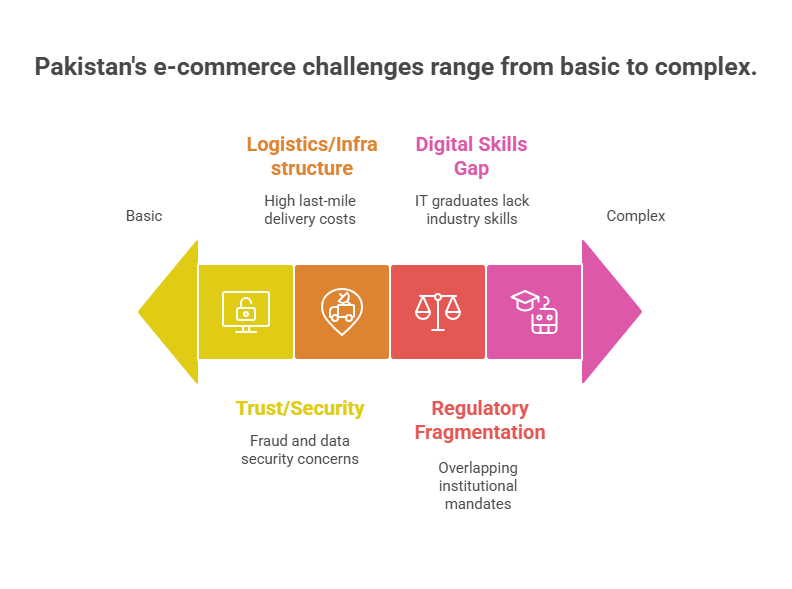

Despite the positive growth trajectory, several challenges continue to constrain Pakistan’s e-commerce potential:

Trust and Security Concerns

Consumer skepticism about online transactions remains high, with fraud concerns and data security issues deterring many potential users from adopting digital payments. The dominance of COD reflects this trust deficit, though it creates operational challenges for businesses through higher return rates and cash handling costs.

Logistics and Infrastructure

Last-mile delivery costs remain high, particularly in rural areas where infrastructure is limited. Non-standard addressing systems and limited coverage by major logistics providers create additional barriers for e-commerce expansion beyond major urban centers.

Regulatory Fragmentation

Overlapping institutional mandates result in inconsistent enforcement of e-commerce regulations, particularly in consumer protection. The lack of a comprehensive legal framework has prevented global payment platforms like PayPal from entering the Pakistani market.

Digital Skills Gap

With 80% of IT graduates lacking relevant industry skills, Pakistan faces a significant digital skills shortage that constrains sector growth. This gap is particularly pronounced in rural areas and among women, limiting the sector’s inclusivity potential.

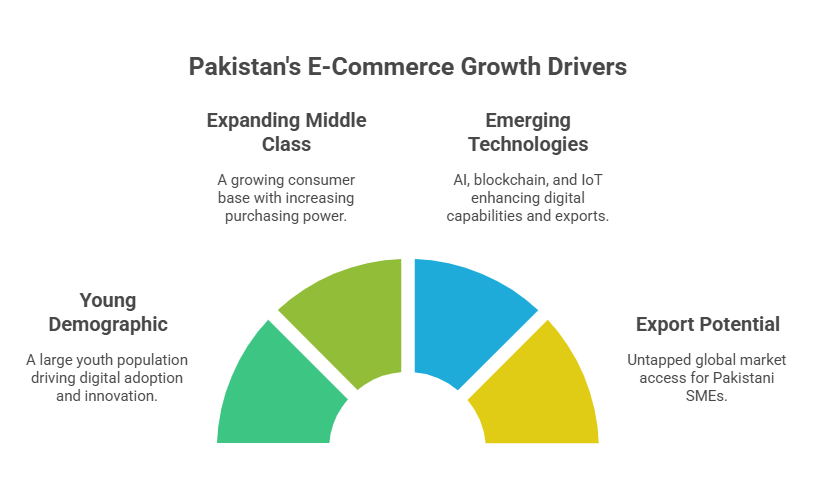

Future Outlook and Opportunities

The future of Pakistan’s e-commerce sector appears promising, with multiple growth drivers aligned. The young demographic profile, with 64% of the population under 30 years old, provides a strong foundation for continued digital adoption. The expanding middle class, projected to exceed 100 million by 2030, represents a massive potential consumer base.

Emerging technologies present additional opportunities. Artificial Intelligence (AI) is projected to contribute $10-20 billion to Pakistan’s digital economy by 2030, with AI-based exports already accounting for 20-30% of top IT firms’ revenues. The integration of blockchain, IoT, and smart city technologies could further accelerate digital transformation across multiple sectors.

Emerging technologies present additional opportunities. Artificial Intelligence (AI) is projected to contribute $10-20 billion to Pakistan’s digital economy by 2030, with AI-based exports already accounting for 20-30% of top IT firms’ revenues. The integration of blockchain, IoT, and smart city technologies could further accelerate digital transformation across multiple sectors.

The export potential remains largely untapped, with platforms like Alibaba and Amazon offering Pakistani SMEs access to global markets. The government’s target of $60 billion in exports by 2028 could be significantly supported by expanded e-commerce participation.

Read More: Pakistan’s E-commerce Market Surges to 46th Position Worldwide

Conclusion

Pakistan’s e-commerce sector has grown fast. It crossed $10.4 billion in 2025. It may reach $12 billion by 2027, says a new ADB report. This growth comes from high smartphone use. Around 80% of shoppers buy online through mobile. But there are still challenges. Payment issues, poor infrastructure, and limited digital access remain.

The ADB suggests reforms, digital education, and support for small businesses and women. With teamwork between the government, private sector, and development groups, e-commerce can create jobs and support growth. This change is more than numbers. It shows how Pakistanis are moving toward a digital future.