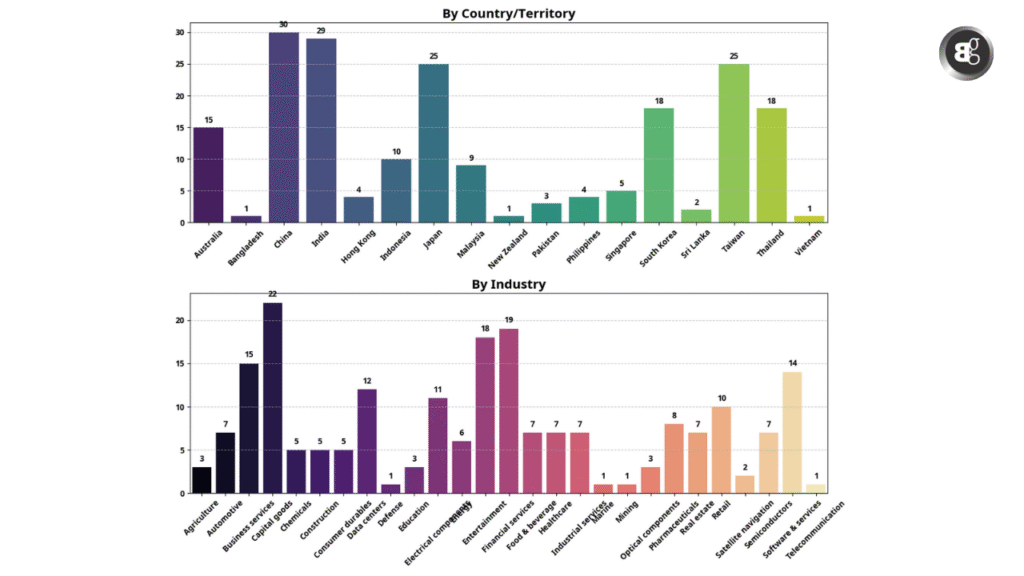

This article is included in Forbes Asia’s Best Under A Billion 2025 coverage, which focuses on 200 publicly traded Asia Pacific businesses with continuous top and bottom line growth and less than $1 billion in revenue. View the complete list here, arranged topically.

The International Monetary Fund (IMF) predicts that growth will continue to weaken as trade tensions loom over the Asia-Pacific region, which has long been regarded as the world’s economic engine. Our annual Best Under A Billion list, which includes 200 small and midsized publicly listed firms with sales above $10 million but below $1 billion, highlights organizations that persevered and, in many cases, prospered during the last year in spite of these difficulties.

Eighteen organizations, more than twice as many as the eight that made the list the previous year, were pushed onto it by the thriving financial services industry. With 13 businesses, primarily from South Korea, making the cut this year, the beauty sector is still thriving. The growing momentum in their respective industries such as data centers, electric vehicles, and renewable energy has helped other businesses in the area. 69 businesses in all were added back to the 2025 list from the year before.

18 companies which exhibit some of the previously mentioned structures are emphasized here:

HD Renewable Energy

Due to rising demand for green energy, Taipei-based HD Renewable Energy Corporation, a business that specializes in solar power and battery storage systems, reported record revenue of NT$10 billion ($310 million) in 2024, up 73% from the previous year. The company’s next move is to enter foreign markets through joint ventures in the Philippines, Japan, and Australia. Most recently, it paid NT$290 million to purchase the development rights to 795MW of energy storage projects in Victoria, Queensland, and New South Wales.

DCI Indonesia

Having 119 megawatts (MW) of installed capacity, DCI Indonesia is already the biggest data center provider in Indonesia. Later this year, its newest data center in Surabaya is expected to go online, adding an additional 9MW. While net profit increased 55% to 796 billion rupees in 2024, revenue increased 39% to 1.8 trillion rupees ($114 million). At 150,700 rupees per share in early July, DCI Indonesia is the most costly stock in the nation. This is a 35,780% gain from the company’s debut in 2021.

IPD Group

Services for power guzzling data centers, such as designing and supplying electrical systems and cooling controls, accounted for 12% of revenues in the year ending June 2024, according to IPD Group, an Australian company. This helped the company’s top line jump 28% to A$290 million ($190 million). Installing EV chargers in key Australian cities is part of the distributor and services provider of electrical goods’ recent shift to sustainability electrical infrastructure.

iFast

Encouraged by Asia’s wealth boom, Singapore based wealth management platform iFast reported a 136% increase in net profit to $66.6 million in 2024, along with a roughly 50% increase in sales to $383 million ($288 million). Additionally, the fintech benefited from the better operation of its digital bank in the United Kingdom, iFAST Global Bank (formerly BFC Bank), which it purchased in 2022 and which reduced its losses by half to $4.4 million last year. With a record S$27 billion of resources under administration at the end of June, iFast hopes to achieve S$100 billion by 2030.

Green Energy KPI

In the year ending in March, KPI Green Energy’s sales increased by 70% to 17.6 billion rupees ($205 million), driven by India’s expanding green power sector. The company’s net profit quadrupled to 3.2 billion rupees. With the support of India’s 500GW energy from renewable sources target, the Surat-based firm, which constructs and runs solar and hybrid power facilities in its native state of Gujarat, says it plans to install over 10 gigawatts of capacity by 2030, up from the present 950 megawatts. For solar power projects, KPI also licenses out portions of its 2,400-hectare land bank.

PharmaResearch

Based in Gangneung, South Korea Rejuran, PharmaResearch’s signature skincare product made from salmon DNA, is its most well known product. The company’s revenue jumped 34% to over 350 billion won ($257 million) in 2024, with sales throughout Asia Pacific, the U.S., and Europe. At the same time, its net profit increased by a fifth to 92 billion won. The firm produces over the counter and prescription medications, including an injection for knee pain, in addition to cosmetics.

Shenzhen Envicool Technology

Income and the net profit for Shenzhen Envicool Technology, a manufacturer of cooling systems as well as machinery for homes, cars, and businesses, both increased by 30% to 4.6 billion yuan ($634 million) and 452 million yuan, respectively. In order to provide environmentally friendly cooling technologies for data centers that are popping up all across Southeast Asia, the business partnered with Malaysia based KJTS Group in June.

Silicon2

Due to K-beauty’s widespread appeal, South Korea-based cosmetics supplier Silicon2 saw a threefold increase in net profit to 120 billion won and a doubling of sales to 692 billion won ($507 million) last year. Kim Sung woon, the company’s founder, began the business in 2002 as a distributor of semiconductor parts before shifting its focus to skincare and cosmetics ten years later in anticipation of the beauty boom. In the last two years, the firm has built stores in France, Indonesia, the United Kingdom, and the United States as well as to its e-commerce site StyleKorean.com.

Conclusion:

This list highlights 200 Asia Pacific companies with strong, consistent growth, chosen from over 19,000 eligible firms with revenues between $10 million and $1 billion. Selection was based on a mix of financial performance including returns, revenue, earnings growth, and debt levels plus strict qualitative checks to rule out governance, environmental, or legal concerns. Only independent, geographically diverse businesses made the cut, using the latest available data as of July 7, 2025.