While India’s quick commerce market is dominated by the 10-minute delivery race, FirstClub is carving out its own niche. Instead of speed, the Bengaluru-based startup is betting on quality, curation, and premium customer experience. And the strategy seems to be working — just three months after launching its app, the 8-month-old company has already tripled its valuation.

At a post-money valuation of $120 million, FirstClub has secured $23 million in Series A funding, led by Accel and RTP Global, with participation from Blume Founders Fund, 2 am VC, Paramark Ventures, and Aditya Birla Ventures. The round follows its $8 million seed funding at a $40 million valuation in December.

Read More: Top 3 Tips for Presenting Your Business Plan

India’s Booming E-Commerce Market

India, home to the world’s second-largest online shopper base, is witnessing exponential growth in e-commerce. The market already generates $60 billion in gross merchandise value (GMV) and is projected to grow 18% annually, reaching $170–190 billion by 2030 (Bain & Company).

Quick commerce players like Blinkit, Swiggy Instamart, Zepto, and even global giants Amazon and Flipkart have embraced ultra-fast deliveries. But in this hypercompetitive landscape, FirstClub has identified a gap: a premium, curated, and trustworthy shopping experience for India’s top 10% of households.

FirstClub’s Unique Proposition

Instead of chasing speed, FirstClub focuses on:

-

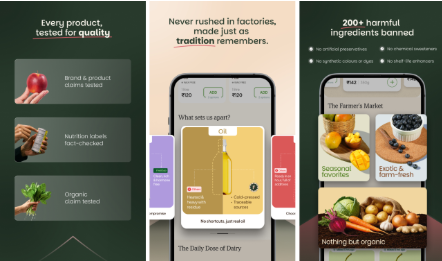

Premium Products: Over 4,000 curated SKUs across groceries, bakery, dairy, nutrition, and fresh produce.

-

Exclusive Selection: 60% of products are exclusive, available neither offline nor on competing platforms.

-

Consumer Testing: A panel of testers blind-tests products (e.g., multiple brands of paneer) to ensure only the best make it to the app.

-

Curated Cart Experience: The app prioritizes browsing over search, encouraging discovery and brand trust.

-

Quality Guarantee: More than 200 harmful ingredients are banned from its supply chain.

The result? Customers are willing to wait longer than 10 minutes if it means they’re getting better quality and service.

Read More: 7 Red Flags That Will Kill Your Startup Before It Grows

Customer Insights

-

Average Order Value (AOV): ₹1,050 (~$12), nearly double that of leading quick-commerce players.

-

Repeat Purchases: 60% repeat rate within three months.

-

Demographics: 70% of customers are women, largely from households earning ₹1.5 million (~$17,000) annually.

-

Customer Filtering: Minimum cart value of ₹199 (~$2.40) ensures targeting of the right customer base.

Leadership & Vision

Founder and CEO Ayyappan R, who previously held senior roles at Flipkart (Myntra, Cleartrip) and ITC, has leveraged his experience to build FirstClub’s foundation in record time. Within six months, the company built an end-to-end tech platform, supply chain network, and dark-store model (“clubhouses”).

“We are not indexing on delivery speed, but on product quality. Every single product has to be top-notch,” Ayyappan said.

Expansion Plans

With fresh funding, FirstClub is preparing to scale:

-

Cafés: Launching freshly made (not preheated) food offerings within 30 days.

-

New Categories: Children’s food, pet food, nutraceuticals, and home goods (decor, essentials, utensils).

-

Geographic Growth: Expanding from 4 to 35 clubhouses in Bengaluru this year before entering new cities.

-

Omnichannel Presence: Slotted delivery, subscription models, offline stores, and possible showroom-style clubhouses for customer engagement.

-

Inspiration: Replicating the Costco, Whole Foods, Trader Joe’s, and T.J. Maxx experience for India.

The company currently employs 185 staff, including a 75-person operations team.

Read More: The importance of strong administrative support systems for entrepreneurs

FAQs

1. How is FirstClub different from other quick commerce startups?

FirstClub focuses on curated, premium-quality products instead of ultra-fast deliveries, targeting the top 10% of Indian households.

2. What is the average delivery time for FirstClub orders?

Deliveries typically take longer than 10 minutes, but prioritize quality, hygiene, and curated selection over speed.

3. Does FirstClub only sell groceries?

No. While it started with groceries, the company is expanding into cafés, pet food, children’s products, nutraceuticals, and home goods.

4. Where is FirstClub currently available?

Right now, FirstClub serves select neighborhoods in Bengaluru through its four “clubhouses,” with plans to expand to 35 by year’s end.

5. Who are FirstClub’s main customers?

Its primary audience is urban households with annual incomes of ₹1.5 million and above, with 70% of the customer base being women.