If there’s one issue the White House, Wall Street, and Silicon Valley can all agree on, it’s that artificial intelligence is now a national priority.

Tech giants are pouring billions into new data centers and cloud infrastructure to power AI. In July, the White House rolled out its official AI action plan, signaling that Washington sees leadership in the field as critical to America’s future. On Wall Street, investors have doubled down on AI, pushing stocks like Nvidia (NVDA) to record highs.

But President Donald Trump’s escalating trade war has raised questions about whether tariffs could undercut this massive AI push. New levies risk driving up the costs of semiconductors, copper, and other materials needed to build the servers and chips at the heart of AI systems.

On August 6, Trump said he would impose a 100% tariff on imported semiconductors, though he promised exemptions for companies investing in U.S.-based manufacturing. In late July, his administration also slapped a 50% tariff on copper, a key material in circuit boards and processors. While these moves create uncertainty around costs, most experts believe tariffs alone won’t derail the AI race—mainly because the stakes of falling behind are simply too high.

For companies like Microsoft, Meta, and Google, losing ground in AI would be far more costly than higher import bills. Dallas Dolen, who leads U.S. technology, media, and telecom for PricewaterhouseCoopers, described the current AI boom as an “existential moment” for Big Tech.

“Cost, if you have enough money, is not the most important variable when you’re told it’s an existential threat,” Dolen told CNN.

Billions Flowing Into AI Infrastructure

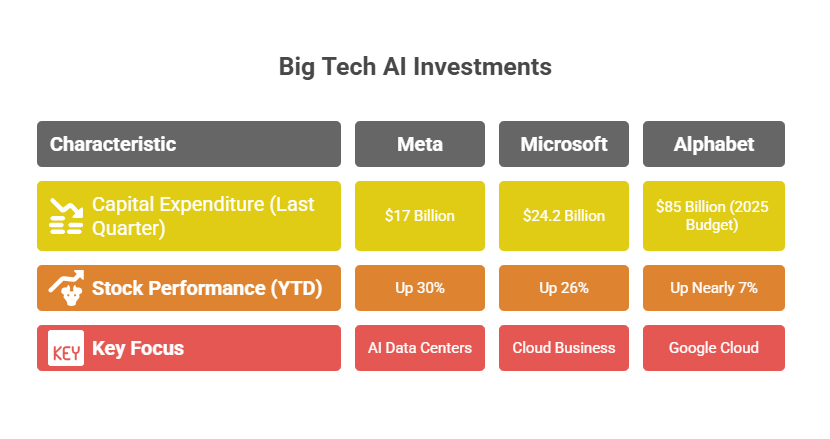

The latest earnings reports from Meta, Microsoft, and Google underline the trend: Big Tech is investing aggressively in AI, and it’s starting to pay off.

-

Meta spent $17 billion in capital expenditures in the quarter ending in June, largely on data centers and servers for AI. The company’s earnings per share jumped 38% year over year, and its stock rose 9% after the announcement. Shares are now up roughly 30% in 2025.

-

Microsoft invested $24.2 billion in capital expenditures last quarter and plans to commit another $30 billion soon. Its surging cloud business helped push its market valuation past $4 trillion, making it the second company after Nvidia to cross that mark. Microsoft shares are up 26% this year.

-

Alphabet boosted its 2025 capital expenditure budget to $85 billion to meet rising demand for Google Cloud. Executives noted that “nearly all GenAI unicorns” rely on Google’s cloud services. Alphabet stock is up nearly 7% year to date.

The need for this infrastructure is immense. Goldman Sachs projects global data center energy demand will jump 50% by 2027 and 165% by 2030 due to AI. Analyst Dan Ives of Wedbush Securities called it the “4th Industrial Revolution,” driven by firms like Nvidia, Microsoft, Palantir, Meta, Alphabet, and Amazon.

The Tariff Question

Even so, tariffs add complexity. PwC estimates that trade measures could lift construction costs for data centers by 5% to 7%. A survey by the National Association of Manufacturers also found rising material costs and trade uncertainty to be top concerns for U.S. manufacturers in 2025.

For smaller firms, these hurdles are more daunting. Unlike Big Tech, they lack billions in cash reserves and face pressure from investors demanding quick returns. Data centers are long-term bets, often taking years to build but operating for decades. According to CBRE, construction timelines between 2015 and 2020 averaged one to three years, and McKinsey estimates a useful life of 25–30 years.

“Uncertainty has a larger impact when you’re committing to a project that takes years to deliver,” said Carnegie Mellon economics professor Laurence Ales.

Trump’s semiconductor tariffs may still leave the door open for tech companies. He pledged exemptions for firms that commit to U.S. production. Both Nvidia and TSMC have already announced plans to expand American operations.

The administration has also shown signs of flexibility. Earlier this month, Trump allowed Nvidia and AMD to continue selling AI chips to China, provided they share 15% of the revenue with the U.S. government through export licenses. Reports also suggest the White House may take an equity stake in Intel.

Washington and Silicon Valley’s Shared Goal

The White House’s AI action plan goes beyond funding and tariffs. It calls for streamlining permits for data centers and semiconductor plants, intending to cement America’s leadership. The U.S. already hosts more data centers than any other country, thanks in part to industry giants like Microsoft, Google, and Amazon.

“We need to be mindful that this is an area where we already have an advantage,” said Matt Pearl of the Center for Strategic and International Studies. “And we don’t want to give that up.”

For Big Tech, tariffs may be an inconvenience, but falling behind in the global AI race would be a significant threat to its existence.