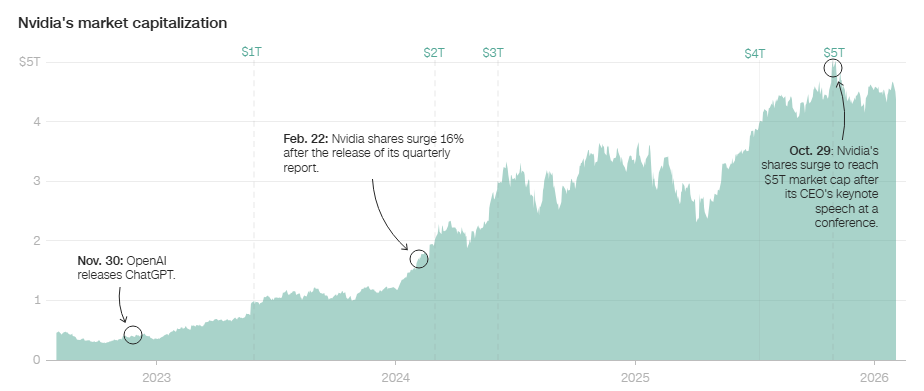

NVIDIA made history in October 2025 by briefly crossing a $5 trillion valuation, a first for any company in the corporate world. The AI boom has been the rocket fuel behind this meteoric rise.

The demand for Nvidia’s AI chips has been insatiable. According to the International Data Corporation, the company now holds an 81% market share in revenue for data center chips. This dominance has sent Nvidia’s stock soaring—twelve times higher since the release of ChatGPT in November 2022.

Why Nvidia Stock Has Exploded

In the October quarter alone, Nvidia’s sales and profits jumped more than 60% compared to last year, far exceeding Wall Street expectations. Last month, the company unveiled its next-generation Vera Rubin chip, seen as the next major growth driver. With all this momentum, Nvidia expects revenue to hit $500 billion in 2026—a staggering number for any tech company.

But success hasn’t come without challenges. The AI field is crowded, competitors like AMD and custom chip developers are nipping at its heels, and some analysts worry about an AI bubble.

From GPUs to AI Factories

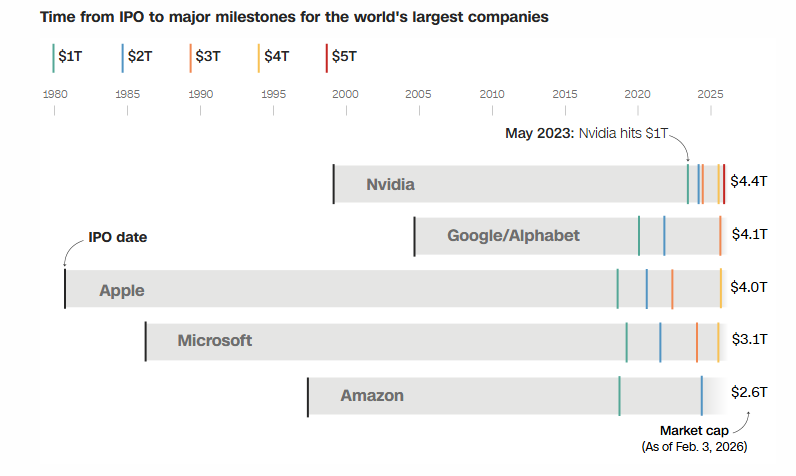

Nvidia started in 1993, founded by Jensen Huang, focusing on graphics processing units (GPUs) for video games. These GPUs unexpectedly became the perfect tool for AI training, turning the company into a powerhouse in data centers.

Image Sources: FactSet, CNN reporting

Graphic: Rosa de Acosta, CNN

Nvidia didn’t just rely on chips. It also offers server racks, specialized software, and AI optimization tools. Huang calls these setups “AI factories,” aiming to build the data centers of the future. Beyond chips, Nvidia is pushing into robots, autonomous vehicles, and quantum computing, including partnerships with Uber for self-driving cars and the US Department of Energy on quantum supercomputers.

Read More: The Story of Jensen Huang, Nvidia’s founder and CEO

The Numbers Tell the Story

-

$5 trillion valuation: reached in October 2025

-

$1 trillion milestone: hit just 29 months earlier

-

Market dominance: 81% of AI data center chip revenue

-

Stock growth: 12x since ChatGPT’s release

NVIDIA has moved faster than almost any tech giant in history. Its partnerships with Microsoft, AWS, Google Cloud, and CoreWeave ensures its chips are at the heart of AI operations globally.

Graphic: Rosa de Acosta, CNN

Global Reach and Challenges

NVIDIA isn’t just focused on the U.S. In Europe, it’s collaborating with telecoms and governments in France, Germany, Italy, and the U.K. In South Korea, over 26,000 chips are being deployed to support AI initiatives.

But there are hurdles. China, once a massive market, has restricted access to high-end Nvidia chips due to U.S. export controls. While Huang has convinced former President Trump to loosen some restrictions, Beijing hasn’t confirmed full access for Chinese companies.

Read More: Trump Says ‘No One Gets Nvidia’s Most Advanced Chips,’ But Huang Warns China Will Win The AI Race

Strategic Deals Fuel Growth

NVIDIA’s partnerships and investments have been crucial. In April 2025, the company pledged $500 billion for AI infrastructure in the U.S. September saw a $5 billion investment in Intel for custom data centers. Shortly after, a $100 billion partnership with OpenAI aimed to expand AI data center capacity around Nvidia chips.

Despite some reported friction between Nvidia and OpenAI, both companies insist the deal remains strong. Meanwhile, Nvidia’s Vera Rubin chips are set to roll out in the second half of 2026, with cloud providers among the first adopters.

The Vision Ahead

Huang isn’t stopping at data centers. He’s pushing Nvidia into autonomous vehicles and robotics, rolling out new AI models and software to power these innovations. “Our vision is that, someday, every single car and every single truck will be autonomous,” Huang said.

For now, Nvidia sits at the center of the AI revolution, with a network of partnerships, groundbreaking chips, and ambitious plans. But with competitors, market restrictions, and the ever-present AI hype, the path ahead will be as challenging as it is lucrative.