The financial world was buzzing when Nvidia CEO Jensen Huang introduced a groundbreaking technology called NVQLink, designed to connect quantum computers with GPU supercomputers. The announcement promised to accelerate breakthroughs in error correction, calibration, and complex simulations, paving the way for the next era of computing.

Huang explained:

“Working together, the right algorithms running on the GPUs, the right algorithms running on the QPUs this is the future of quantum computing.”

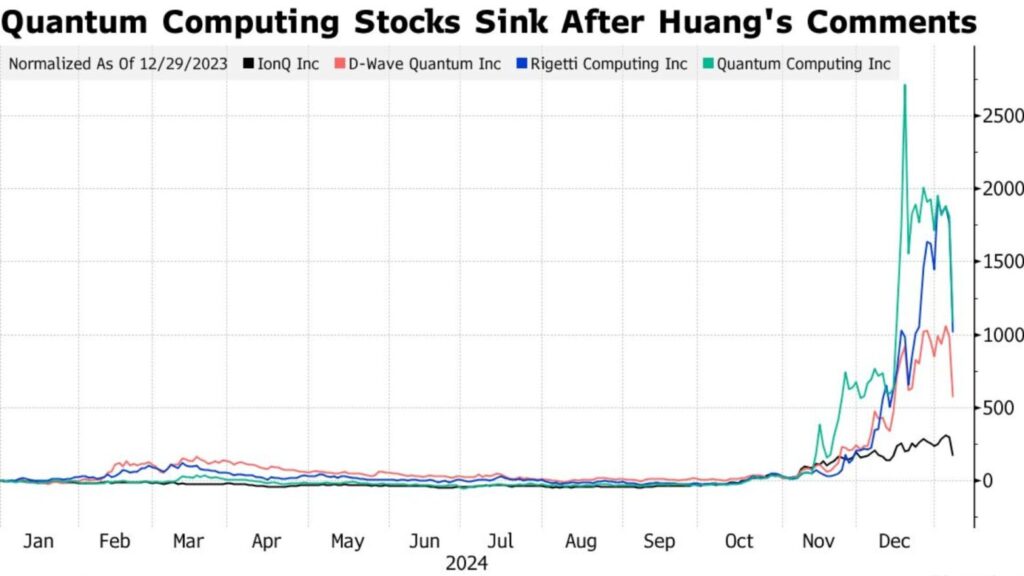

Initially, investors reacted with excitement. Stocks of quantum computing firms like Rigetti Computing (RGTI), IonQ (IONQ), D-Wave Quantum (QBTS), and Quantum Computing Inc. (QUBT) all spiked sharply following the news.

Quantum Stocks Surge Then Suddenly Fall

Here’s how the major players moved after Nvidia’s announcement:

-

Rigetti Computing (RGTI) rose 6.31% to $39.03

-

IonQ (IONQ) gained 6.98% to $60.57

-

D-Wave Quantum (QBTS) climbed 7.00% to $33.99

-

Quantum Computing Inc. (QUBT) added 4.29% to $15.43

However, this excitement was short lived. Soon after, Nvidia announced that it was partnering with the U.S. Department of Energy (DOE) to build seven new AI supercomputers, which led investors to mistakenly assume that quantum initiatives were being sidelined.

Read More: Nvidia Becomes First $5 Trillion Company Amid Global AI Boom

Within hours, those same stocks reversed course and fell into the red, despite the fact that Huang’s message was about integration, not competition, between quantum processors (QPUs) and GPUs.

Analysts Call It a “Misread” by Investors

Industry experts quickly tried to calm the market’s knee-jerk reaction. David Williams, an analyst at Benchmark Co., commented:

“It’s surprising to see the misread here. This should be a positive the ability for QPUs and GPUs to work together.”

Williams pointed out that the collaboration could accelerate the practical use of quantum computing something Nvidia’s own research supports. According to McKinsey & Company, the quantum computing market could grow from $1.3 billion in 2024 to over $10 billion by 2030, provided hybrid GPU–QPU systems become mainstream.

What NVQLink Means for Quantum Computing

Nvidia’s NVQLink aims to bridge the gap between quantum processors and traditional GPUs a step that could make quantum simulation and modeling far more efficient.

Key Benefits of NVQLink:

-

Hybrid Processing: Combines the massive parallel power of GPUs with quantum precision from QPUs.

-

Improved Error Correction: Reduces one of the biggest challenges in quantum computing.

-

Advanced Simulations: Enables testing of complex AI and physics models faster than ever before.

-

Cross-Sector Potential: From drug discovery to cybersecurity, industries could see faster innovation cycles.

By collaborating with quantum companies like Rigetti and IonQ, Nvidia is creating a unified ecosystem where AI and quantum computing can co-evolve rather than compete.

See More: OpenAI Turns Into Public Benefit Corporation with Microsoft

The Emotional Shift on Wall Street

The sudden sell-off of quantum stocks highlighted a shift in investor sentiment. For months, traders have been quick to buy on hype but this time, they were looking for reasons to take profits or cut exposure.

Market watchers say this might be a sign of maturing expectations in the quantum sector. Investors are beginning to realize that quantum computing is still in its early stages, and collaboration with AI may be the only way forward in the near term.

What’s Next for Quantum Stocks

Despite the short-term volatility, analysts believe that the long-term outlook for quantum stocks remains strong.

-

According to Deloitte’s 2025 Tech Report, by 2035, quantum computing could contribute over $700 billion to the global economy.

-

Rigetti and IonQ, both listed as “partners” in Nvidia’s release, are expected to benefit directly from NVQLink-enabled projects in the coming years.

This partnership may signal the beginning of a new hybrid era where AI supercomputers and quantum processors collaborate to solve the world’s toughest problems.

Key Takeaways

-

Nvidia’s NVQLink connects GPUs with quantum computers for faster processing.

-

Quantum stocks spiked 6–7% but later dropped after investor confusion.

-

Analysts call this a “misread,” not a negative event.

-

Quantum–AI integration could drive $10B+ in market growth by 2030.

-

Nvidia’s collaboration with Rigetti and IonQ cements the future of hybrid computing.

Conclusion: A Misunderstood Win for Quantum Tech

While traders reacted nervously, the truth is that Nvidia’s NVQLink announcement is a breakthrough, not a setback. It shows a future where AI and quantum computing don’t compete they collaborate.

As the technology matures, companies like IonQ, Rigetti, and D-Wave may emerge as core pillars in the next generation of computing. And this time, the “dip” in stock prices might just be a buying opportunity for those who understand the real story behind the headlines.