The question isn’t whether AI will transform the global economy – it already has.

The real question is: who’s going to own the next two years?

We’re watching the most consequential technology race since the internet boom, and the stakes have never been higher.

Let me cut through the noise and show you what the actual data tells us about who’s winning.

The State of Play: Where We Stand Right Now

Here’s something that might surprise you: the company everyone thought would dominate AI in 2025 just lost half its market share. OpenAI, which commanded 50% of enterprise AI spending in 2023, has plummeted to 27% by 2025. Meanwhile, a company that barely registered on the radar two years ago – Anthropic – now captures 40% of enterprise spending.

But before you crown a winner, understand this: we’re not watching a two-horse race. This is a complex, multi-layered competition spanning foundation models, cloud infrastructure, enterprise software, hardware, and regulatory influence. Different companies are winning different battles.

The Enterprise Model War: Anthropic’s Surprising Surge

Let’s start with the numbers that matter most to businesses actually deploying AI.

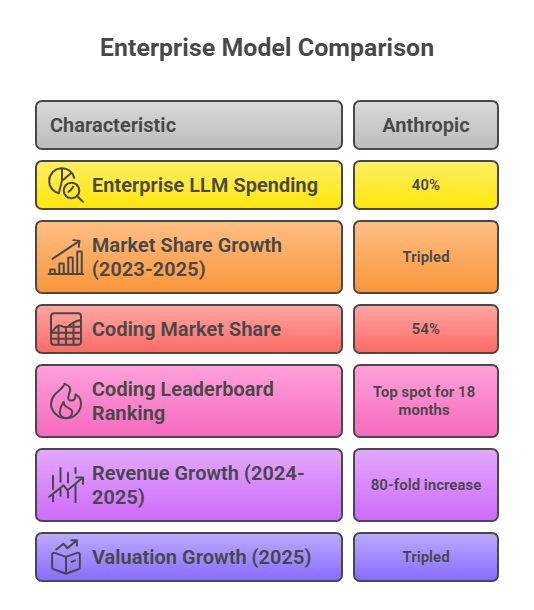

Anthropic has executed what might be the most successful enterprise play in AI history. According to Menlo Ventures’ 2025 State of Generative AI report, Anthropic now earns 40% of enterprise LLM spending – up from just 12% in 2023. That’s not a typo. They’ve more than tripled their market share in two years.

Their secret weapon? Coding. Anthropic commands an estimated 54% market share in coding applications, driven largely by Claude Code’s popularity. They’ve held the top spot on LLM coding leaderboards for 18 consecutive months since Claude Sonnet 3.5 launched in June 2024.

When Google released Gemini 3 Pro in mid-November 2025, leading most benchmarks, it still trailed Claude Sonnet 4.5 on SWE-bench Verified – the gold standard for code generation.

The financial trajectory backs this up: Anthropic’s annualized revenue exploded from $87 million in early 2024 to $7 billion by late 2025 – an 80-fold increase. They’re reportedly raising $5 billion at a $170 billion valuation, nearly triple their earlier 2025 valuation.

Read More: Anthropic Announces $50 Billion AI Infrastructure Project

OpenAI’s User Growth vs Financial losses

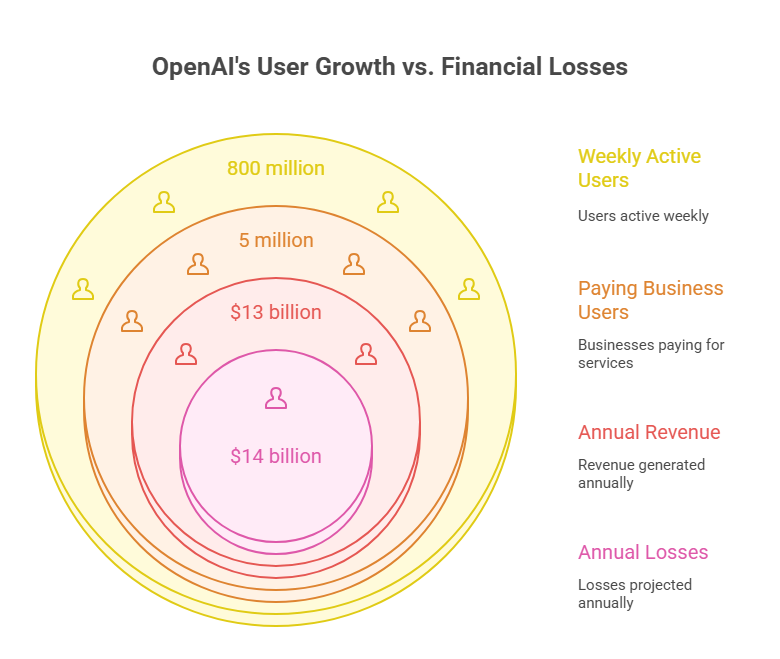

OpenAI remains formidable despite losing enterprise market share. Their consumer dominance is undeniable: 800 million weekly active users, $13 billion in annualized revenue by July 2025 (up from just $200 million in early 2023), and over 5 million paying business users. ChatGPT message volume grew 8x year-over-year, and API reasoning token consumption per organization increased 320x.

But here’s the problem: OpenAI is burning $8.5 billion annually with projected losses of $14 billion by 2026.

They won’t reach cash flow positive until 2029, according to their own projections. They’re also losing their exclusive relationship with Microsoft—their revised October 2025 partnership agreement allows OpenAI to diversify cloud providers and enables Microsoft to independently pursue AGI.

Read More: OpenAI Releases “Your Year with ChatGPT” Recap for 2025

Google made the most dramatic comeback of 2025. After starting the year perceived as trailing OpenAI, they’ve fundamentally shifted the narrative.

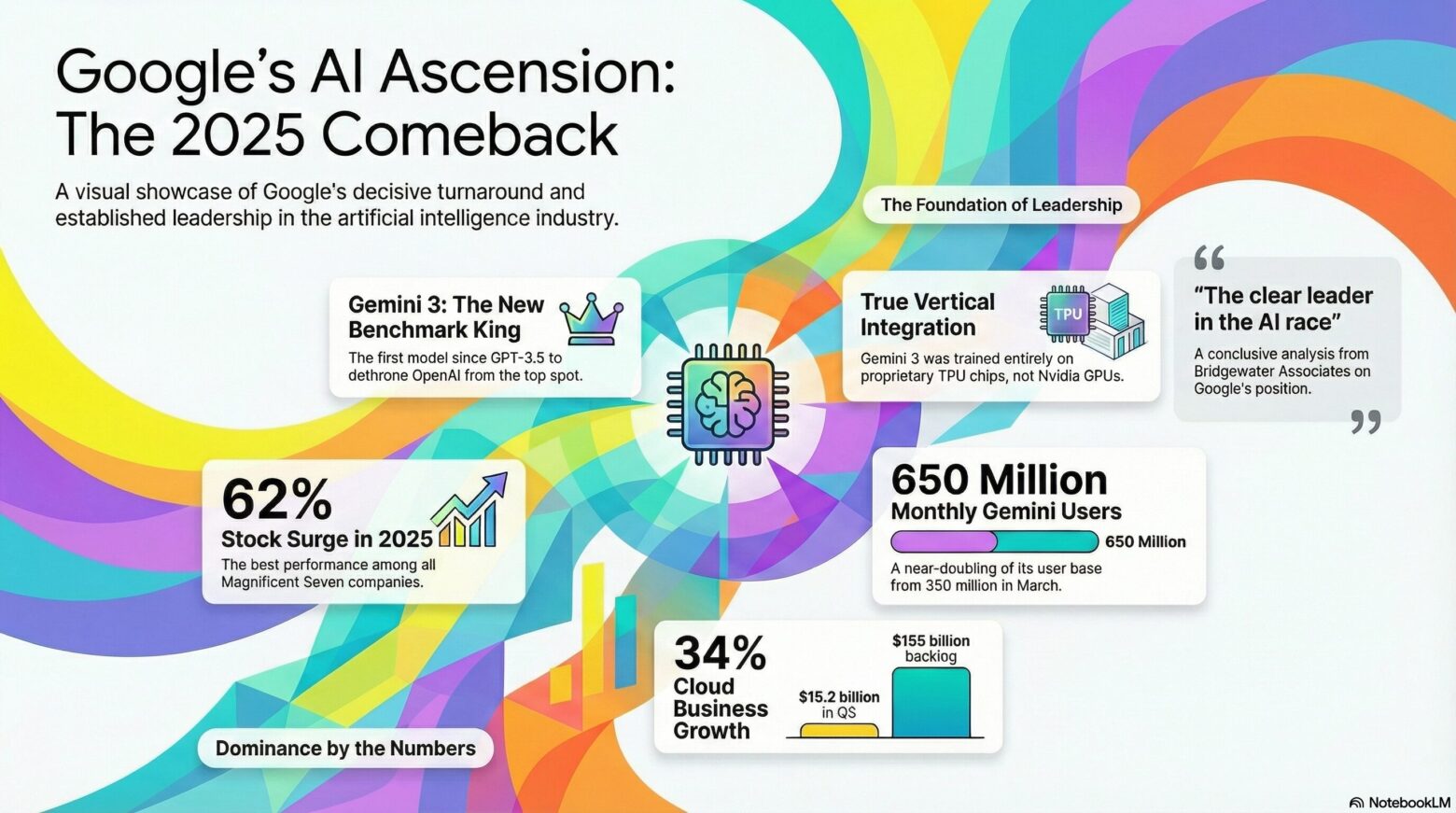

Gemini 3, launched November 18, 2025, topped benchmark leaderboards across text generation, image editing, and multimodal tasks – marking the first time since GPT-3.5’s launch that OpenAI doesn’t have the leading model.

Google’s AI revenue is embedded in their cloud business, which grew 34% year-over-year to $15.2 billion in Q3 2025, with a staggering $155 billion cloud backlog. The Gemini app now has 650 million monthly active users (up from 350 million in March), while AI Overviews serves 2 billion monthly users. Alphabet’s stock surged 62% in 2025 – the best performance among Magnificent Seven companies.

Most importantly, Google trained Gemini 3 entirely on their proprietary TPU chips, not Nvidia GPUs, demonstrating true vertical integration from silicon to software.

Bridgewater Associates’ analysis concluded that

“Google is now the clear leader in the AI race” with “a significant advantage in training frontier models.”

Read More: Google plans to restart green card applications in 2026. Here’s who won’t be eligible.

The Cloud Infrastructure Battle: Microsoft’s Massive Bet

Microsoft operates as the AI economy’s essential infrastructure. Azure’s AI revenue hit a $26 billion annual run rate in 2025, with 80% of Fortune 500 companies using Azure AI Foundry for their workloads. The company’s Intelligent Cloud segment generated $30.9 billion in Q3 2025 (33% YoY growth), with server products and cloud services revenue up 23%.

Microsoft holds a 27% equity stake in OpenAI valued at $135 billion, retains exclusive IP rights through 2032, and maintains Azure API exclusivity until AGI is declared. They’ve committed $80 billion in AI infrastructure capex for 2025, with projections suggesting $120 billion for 2026. Their M365 Copilot is now used by 70% of Fortune 500 companies.

But Microsoft faces serious headwinds. Azure capacity constraints will persist through fiscal year-end. Their exclusive cloud relationship with OpenAI has ended – OpenAI contracted to purchase $250 billion in Azure services, but can now use other cloud providers. Most concerning, Microsoft reluctantly added Anthropic models to GitHub Copilot in early 2025, cutting their margins as they buy tokens from a competitor at 50-60% gross margins instead of serving their own.

The market data shows Microsoft capturing 22% of global cloud infrastructure spending, behind AWS but ahead of Google Cloud. Azure’s growth rate (33%) significantly exceeds AWS (18%), but Google Cloud is growing even faster at 34%.

Read More: UAE 2026: The Energy Reality Behind Microsoft’s $15.2B Abu Dhabi Data Center Expansion

The Hardware Foundation: Nvidia’s Unshakeable Moat

Here’s a stat that puts everything in perspective: Nvidia’s revenue from just its previous-generation Hopper chips surpasses the combined data center compute revenue of AMD, Broadcom, and Marvell. That’s not their total revenue—just one product line beating all competitors combined.

NVIDIA

NVIDIA reached a $5 trillion market capitalization in late October 2025. Data center revenue hit $51.2 billion in fiscal Q3 2026 (up 66% YoY), representing 90% of their $57 billion total revenue. The entire 2025 production of Blackwell chips sold out by November 2024, before the official announcement. Gross margins remain at an eye-watering 73.6%.

Blackwell delivers unprecedented performance: 208 billion transistors, 10TB/second chip-to-chip connectivity, and up to 25x better cost and energy efficiency than its predecessor for real-time generative AI. The platform enables training and inference for models scaling to 10 trillion parameters.

But competition is mounting. Google’s TPU v7 “Ironwood” offers 40-60% lower total cost of ownership for Gemini models. Amazon’s Trainium2 powered the training of Anthropic’s Claude 4, proving frontier models can be built without Nvidia hardware. Roughly 80% of AI compute spend has shifted toward inference rather than training—playing into the hands of specialized ASIC developers.

NVIDIA CEO Jensen Huang’s response? “NVIDIA is a generation ahead of the industry – it’s the only platform that runs every AI model and does it everywhere computing is done.” The CUDA ecosystem with 4+ million developers and 3,000+ optimized applications remains Nvidia’s true moat, not just the hardware.

Read More: The Story of Jensen Huang, Nvidia’s founder and CEO

The Regulatory and Safety Dimension: Who Shapes the Rules?

The EU AI Act entered force on August 1, 2024, with full applicability by August 2, 2026. General-purpose AI model rules became effective August 2, 2025. This represents the world’s first comprehensive AI legal framework and will likely influence global standards similar to GDPR.

Anthropic

Anthropic positions itself as the “safe” choice through its Constitutional AI methodology, capturing enterprise customers in heavily regulated industries like healthcare and finance. Google benefits from extensive experience navigating European regulation and has allocated $80 billion in 2025 toward AI R&D – one of the largest AI budgets globally.

Microsoft

Microsoft serves as a key player in the U.S. government’s “AI Safety” and “Chip Independence” initiatives. Their domestic data center footprint provides a strategic advantage amid tightening chip export controls to China. However, the FTC and European Commission forced Microsoft to unbundle Teams from Office 365 globally in 2025 to settle antitrust concerns.

The regulatory landscape will increasingly favor companies with demonstrated safety practices, transparent operations, and geographic diversification to meet varying international requirements.

Market Projections: Follow the Money

The AI market is projected to grow from $371.71 billion in 2025 to $2,407.02 billion by 2032—a 30.6% CAGR. Enterprise AI spending reached $37 billion in 2025, up from $11.5 billion in 2024 (3.2x growth). By some estimates, there are now at least 10 AI products generating over $1 billion in ARR and 50 products exceeding $100 million in ARR.

Total quarterly cloud ARR additions grew from $5.9 billion in Q1 2022 to $21.4 billion in Q2 2025 – a four-fold increase directly attributable to AI’s transformative impact. Fortune 500 companies show 92% adoption of generative AI by mid-2025.

The Verdict: Multiple Winners in Different Arenas

Here’s the truth nobody wants to hear: there won’t be one winner in 2025-2027. This isn’t like the smartphone wars where Apple and Samsung emerged victorious. AI is too multifaceted.

For near-term leadership (2025-2026):

Google has the strongest position for overall AI technology leadership. They’ve achieved vertical integration from custom silicon (TPUs) to frontier models (Gemini 3) to mass distribution (Search, Android, YouTube, Cloud).

Their 62% stock performance in 2025 reflects market recognition of this integrated advantage. Deepwater Asset Management projects Google as “the best performing Mag 7 stock in CY26.”

Microsoft dominates enterprise AI infrastructure and will continue extracting massive value from its Azure platform and productivity suite integration. With 70% of Fortune 500 using M365 Copilot and 80% using Azure AI Foundry, they’re embedded in enterprise workflows in ways competitors can’t easily replicate.

Anthropic is winning the enterprise foundation model market, especially for coding and regulated industries. Their 40% enterprise market share and 54% coding market share position them as the go-to alternative to OpenAI for serious enterprise deployments.

Nvidia maintains hardware dominance despite custom chip competition. The shift to annual architecture releases (Blackwell 2025, Vera Rubin 2026, Rubin Ultra 2027) and the CUDA moat ensure they remain indispensable for frontier AI research and training.

For long-term leadership (2027 and beyond):

The company most likely to dominate the next era is Google. Here’s why:

- Vertical Integration: They control the entire stack from chips to cloud to models to billions of users. Nobody else can match this.

- Economic Sustainability: Unlike OpenAI’s cash burn model, Google’s AI enhances existing profitable businesses. Cloud backlog of $155 billion provides multi-year revenue visibility.

- Scale Advantages: Training Gemini 3 on proprietary TPUs demonstrates that they can innovate without dependency on external suppliers. This becomes crucial as chip access becomes geopolitically constrained.

- Distribution: 2 billion people use AI Overviews in Search monthly. Gemini comes pre-installed on all new Android devices. This embedded distribution is nearly impossible to overcome.

- Research Depth: Google invented the Transformer architecture (the “T” in GPT). Their AI research legacy and talent concentration remain unmatched.

The counterargument is Microsoft, based on their:

- $80-120 billion annual AI infrastructure investment capacity

- Enterprise software monopoly creating captive AI customers

- 27% ownership of OpenAI provides exposure to a potential breakthrough

- Azure’s position as AI’s primary commercial gateway

OpenAI remains dangerous because:

- 800 million weekly users create an unmatched scale for reinforcement learning

- Consumer AI dominance ($13B ARR) funds continued frontier research

- Historical pattern: companies with the best models attract the best talent, creating a virtuous cycle

What This Means for 2025-2027

We’re entering what Bridgewater calls AI’s “resource grab phase” – more dangerous and capital-intensive than earlier stages. Companies will spend whatever it takes to secure compute, chips, and power. A massive increase in capex is coming beyond levels wildly above expectations two years ago.

The path to widespread AI adoption has become more surmountable with Gemini 3’s capability jump. Most organizations haven’t yet embedded AI into workflows despite broad tool availability, presenting an opportunity for firms moving quickly.

The “winner-takes-most” dynamic in enterprise AI will intensify. As AI becomes infrastructure, switching costs rise dramatically. The companies establishing themselves in 2025-2027 will be extraordinarily difficult to dislodge by 2030.

The Bottom Line

If forced to pick one company most likely to lead AI by 2027, the data points to Google. Their combination of technological superiority (Gemini 3 leading benchmarks), vertical integration (chips through models), economic sustainability (profitable AI within existing business), massive distribution (billions of users), and accelerating momentum (62% stock surge, 34% cloud growth) creates the most complete AI powerhouse.

But watch Microsoft closely. Their infrastructure position and enterprise lock-in could prove more durable than raw technical leadership. And never count out OpenAI – they’ve surprised everyone before, and their consumer moat with 800 million weekly users remains formidable.

The reality? We’re watching a three-way race between Google’s integration, Microsoft’s infrastructure, and OpenAI’s consumer dominance, with Nvidia profiting from everyone’s hardware needs and Anthropic capturing the enterprise crown.

The next two years will be absolutely crucial. The companies that execute well from 2025 to 2027 will likely control AI for the next decade. Based on current trajectories, Google looks positioned to emerge as the overall leader – but this race is far from over.