The past few years have reshaped the retail world. Between a global pandemic, record breaking inflation, and changing shopping habits, U.S consumers have become more price conscious and convenience driven than ever. In that environment, Walmart and Target two of America’s biggest retailers faced the same challenges but ended up on very different paths.

Walmart leaned into essentials, delivery speed, and e-commerce. Target, meanwhile, stumbled with discretionary products and struggled to bring its in store magic online.

Walmart’s Winning Strategy

What gives Walmart the upper hand is simple: it sells what people need every week groceries, cleaning products, and other everyday basics. When prices rose and budgets tightened, Walmart became the go to for millions of households.

On top of that, Walmart expanded its Walmart+ membership and doubled down on fast delivery. Analysts point out that Walmart can reach 95% of U.S. households in just three hours a huge advantage when shoppers expect Amazon level convenience.

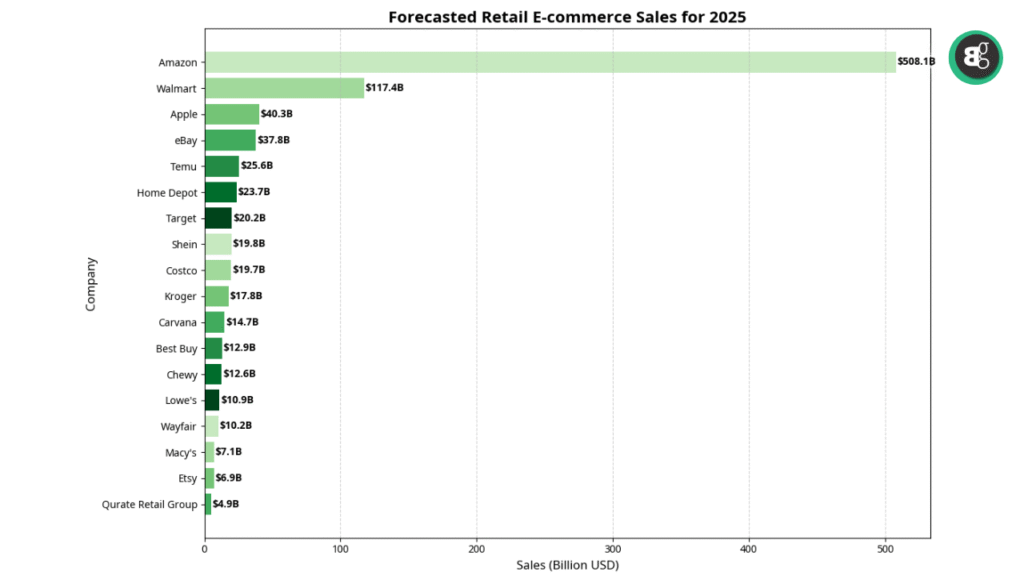

Its online marketplace also exploded, with more than 200,000 active third party sellers offering everything from electronics to household goods. That variety has made Walmart the clear number two in U.S e commerce, just behind Amazon.

Target’s Struggles in E-Commerce

Target is still a household favorite, but its strengths didn’t translate well online. The company poured resources into private label fashion and home brands products that work beautifully in stores but don’t always click with online shoppers.

The result? While Walmart’s global e-commerce sales jumped 25%, Target managed only a modest 4.3% increase in the same period. According to eMarketer, Walmart now holds 9.4% of U.S. e-commerce sales, while Target sits far lower at 1.6%, behind even Home Depot and Apple.

Another problem: Target’s invite only marketplace, Target Plus, has just over 1,300 sellers. Compare that with Walmart’s 200,000+ and the gap is clear.

The “Target Run” Problem

Part of Target’s charm has always been the in store experience the “Quick Target Run” that somehow turns into a cart full of finds you didn’t plan to buy. But that sense of discovery and fun doesn’t translate easily online.

E-commerce is transactional. People go online when they know what they need, and Walmart’s focus on essentials fits that model perfectly. Target’s more curated, style driven approach is harder to replicate on a website or app.

Walmart Takes a Page from TikTok and Amazon

Walmart has been quietly reshaping how people shop online. Instead of relying only on its website, the retail giant is leaning into platforms where people already spend hours like TikTok. From in feed ads that pop up while you scroll to influencer driven Affiliate Programs, Walmart is making shopping feel like part of your social feed.

Key Points

-

Walmart is tapping into TikTok trends to make shopping more social and fun.

-

Launched an affiliate program for influencers, letting creators earn while promoting products.

-

Borrowing ideas from Amazon’s playbook, but tailoring them to Walmart’s style.

-

Holds strong as the #2 e-commerce player in the U.S., right behind Amazon.

Why Walmart Pulled Ahead

-

Groceries drive repeat shopping: staples bring customers back regularly.

-

Faster delivery at scale: Walmart matches Amazon level speed.

-

Massive seller network: a marketplace with 200,000+ sellers.

-

Smart use of TikTok and social media: meeting shoppers where they already spend time.

-

Everyday low prices: a strategy that resonates during inflation.

Target, by contrast, has been caught between its traditional strengths and the realities of digital shopping.

Conclusion

Walmart didn’t just outspend or outgrow Target; it understood where consumer habits were heading. Essentials, convenience, and affordability became the pillars of modern retail, and Walmart leaned into them at the right time. Target is far from finished its brand still carries weight, and its stores remain popular. But in the online shopping wars, the scoreboard is clear: Walmart has taken the lead, and Target has work to do if it wants to catch up.

In Short: This blog compares Walmart and Target’s retail performance in recent years, showing how Walmart has outpaced Target in both in store and online sales. Walmart’s strength lies in essentials like groceries, faster delivery, and partnerships with platforms like TikTok, while Target struggles with discretionary products and brand perception. Analysts note that Walmart and Amazon are setting the pace, leaving Target playing catch up.