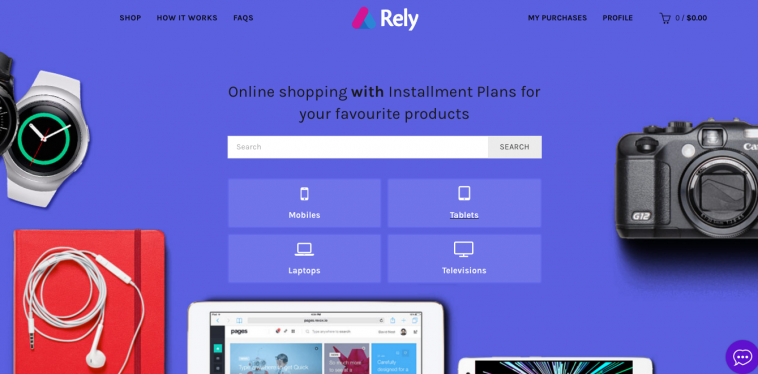

Singapore’s fintech startup Onelyst has brought loans and ecommerce on one podium. The startup launched its new product Rely on November 1st which targets the income group that cannot afford to pay for credit cards. It allows them to purchase a product of their choice and pay through installment plans. For one of the first partner for its product, this startup has nabbed a major online retailer from the market. It also plans to make an entrance into the Indonesian market in March next year.

Fulfilling the needs of people:

According to Mohamed Abbas, co-founder of the Onelyst, with Rely we are just trying to help those people who cannot pay for the necessary products through credit cards. After studying the database, it revealed that a large number of people do have stable incomes and payment capacity but they lack credit options.

Rely is the first of its kind platform in Singapore but these type of opportunities are already available in other countries. Such as in US GetFinancing and FuturePay are both platforms that provide customers with the option of buying products on credits from participating retailers.

How does it Work?

“Rely” works as a mobile-friendly website that focuses on consumer electronics. It aims to grow into a mobile application for offering a large variety of products to customers. Partner retailers on this platform offer users the option of choosing products from hand phones to tablets before requesting them to purchase on credit. After that, the startup utilizes its internal score to complete its credit agreement. This internal score is created with the help of profound analytics as well as analysis of non-traditional data scores through user’s digital tracks. Once the user’s credit option is approved, he/she receives the merchandise and is allowed to repay through installments.

Future in a growing market:

The rapidly growing Singapore’s ecommerce market was valued as US$ 1 billion last year. This new product website aims to enter into this ecommerce market. According to reports of Google and Temasek Holdings, by 2025 Singapore’s ecommerce market is predicted to be worth of US$5.4 billion.

This startup has already planned to introduce itself into the Indonesian market in March next year and is in discussion with partners and consumers of that region. According to Abbas, Indonesia is under big digital penetration with 88 million active internet users currently. The credit card penetration as compared to digital penetration is just 6% so Rely will be very helpful for people who do not possess credit cards.

Onelyst startup has refused to tell the exact figures it is aiming for but it will soon be conducting its pre-Series A funding to make investments for its product development and expansion plans. Abbas expects that all the efforts will be helpful in accelerating financial inclusion in Southeast Asia. This financial inclusion in the region will upgrade the living, education, health, and overall wellbeing of the people. A suitable access to credit can be really useful in changing people’s lives such as starting their own business or sending children to school.

Via: Tech in Asia