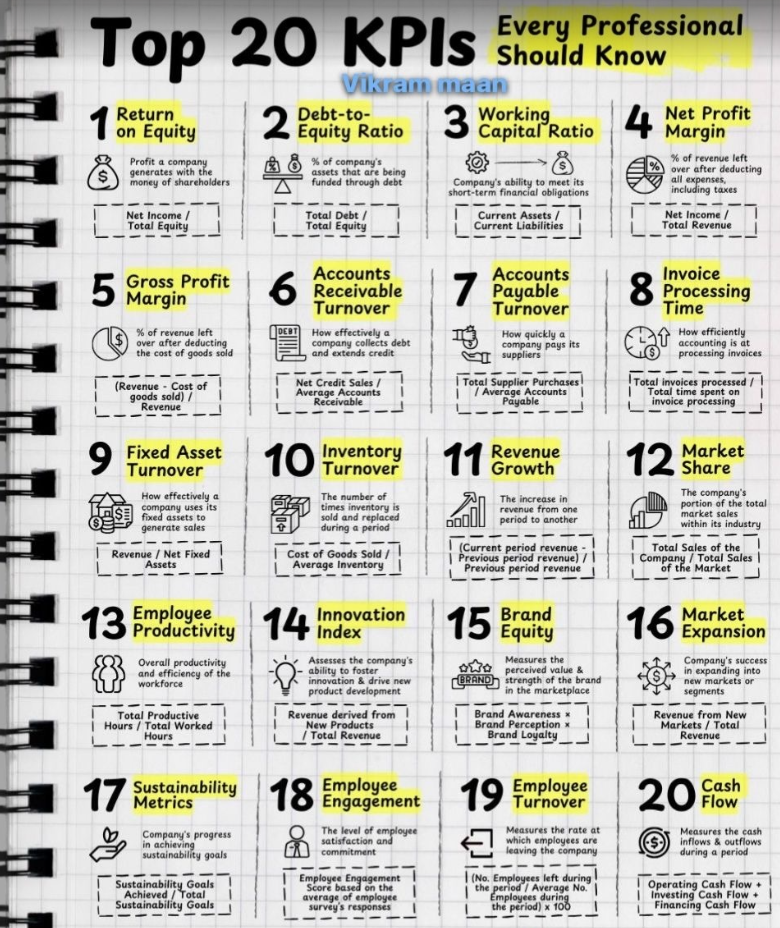

If you’re a business owner, startup founder, or just trying to make sense of all the numbers flying around your dashboard this one’s for you.

You don’t need an MBA to understand what makes your business tick. You just need the right numbers to track. Not all metrics matter equally, but the 20 KPIs below? These are the ones that can genuinely help you make better decisions, increase profits, and grow sustainably.

So, Let’s Get Started

No 1. Return on Equity (ROE)

ROE shows you how much profit a company generates from its shareholders’ money. Think of it as: “For every dollar invested by owners, how many dollars of profit did we create?”

Formula:

Net Income / Total Equity

Human perspective:

If you owned a pizza shop with $10,000 invested, and ended up with $2,000 profit, that’s a 20% ROE. That’s a very tangible way to see whether your sweat and cash are actually paying off.

No 2. Debt to Equity Ratio

This ratio compares a company’s total debt with the money its owners invested. It shows how much of the business is funded by debt vs. equity.

Why does it matter?

Too much debt? That’s risky. A balanced ratio signals stability. Investors and banks pay close attention to this.

Formula:

Total Debt / Total Equity

Human perspective:

If you’re running your house finances, this is a bit like checking whether you’re living off credit cards or your own savings. Same logic, just on a bigger business scale.

No 3. Working Capital Ratio

It measures if your business can pay its short term bills. If this ratio is too low, you might struggle to pay salaries or suppliers. If it’s too high, maybe your money is sitting idle.

Formula:

Current Assets / Current Liabilities

Human perspective:

Think of it like this: can you cover your monthly household bills with what’s in your checking account? Working capital tells you that for your business.

No 4. Net Profit Margin

Out of every dollar of revenue, how much actually ends up as profit after all expenses?

Why does it matter?

High revenue is meaningless if expenses eat it all up. This margin shows how efficient you really are.

Formula:

Net Income / Total Revenue

Human perspective:

It’s like your personal income: earning $5,000 a month sounds great but if $4,900 goes to rent, bills, and debt, your “profit” is tiny. The same logic applies to a business.

No 5. Gross Profit Margin

It shows what’s left after subtracting only the direct costs of producing goods or services.

Why does it matter?

It helps you price products properly and manage production costs.

Formula:

(Revenue Cost of Goods Sold) / Revenue

Human perspective:

Imagine you bake cupcakes: if they sell for $4 and cost you $1.50 to make, the gross profit is $2.50. That’s the money left to pay rent, staff, marketing, and yourself.

No 6. Accounts Receivable Turnover

It shows how quickly you collect money from customers who owe you.

Why does it matter?

Faster collections mean healthier cash flow and less risk of bad debts.

Formula:

Net Credit Sales / Average Receivables

Human perspective:

If your customers take months to pay you, your bank account suffers. This KPI helps spot that problem early, so you can act.

No 7. Accounts Payable Turnover

How quickly your business pays its own bills to suppliers.

Why does it matter?

Paying on time builds trust and sometimes gets you discounts.

Formula:

Total Supplier Purchases / Average Payables

Human perspective:

If you’re always late paying your electricity bill, your power might get cut off. Same with a business keeping up with payables is about respect and financial health.

No 8. Invoice Processing Time

The average time it takes from receiving an invoice to getting it approved and paid.

Why does it matter?

The longer this takes, the higher the chance of late fees, missed discounts, and strained supplier relationships.

Formula:

Total Time to Process Invoices / Number of Invoices

Human perspective:

Think of it like paying your phone bill: if you wait too long, they’ll cut you off. Speed matters.

No 9. Fixed Asset Turnover

This shows how effectively your expensive physical assets (like buildings or equipment) create revenue.

Why does it matter?

You want to know if those big investments are pulling their weight.

Formula:

Revenue / Net Fixed Assets

Human perspective:

If you buy a $30,000 oven for your bakery, you’d better see enough cupcake sales to justify it.

No 10. Inventory Turnover

How many times you completely sell and replace your inventory over a time period.

Why does it matter?

Slow turnover can mean waste, obsolescence, or cash tied up in unsold goods.

Formula:

Cost of Goods Sold / Average Inventory

Human perspective:

Imagine you buy a pile of shoes to resell. If they sit for months, you lose cash flow. The faster they move, the healthier your business is.

No 11. Revenue Growth

The increase in revenue over a period.

Why does it matter?

Revenue growth is the engine of business without it, you stagnate.

Formula:

(Current Revenue Previous Revenue) / Previous Revenue

Human perspective:

Think of it like a career: if you earn more every year, you’re growing. Same with a company.

No 12. Market Share

Your share of the total industry sales.

Why does it matter?

It tells you how strong your position is in a competitive market.

Formula:

Your Sales / Total Market Sales

Human perspective:

If 1,000 people buy coffee in your town each month, and you sell 100 of those, you own 10% of the market. That’s your slice of the pie.

No 13. Employee Productivity

How efficiently your people are working.

Why does it matter?

Higher productivity means more output with the same resources a win win for everyone.

Formula:

Total Productive Hours / Total Worked Hours

Human perspective:

It’s like asking: “How much of my day is actually productive vs. lost in distractions?” The same applies to teams.

No 14. Innovation Index

Measures how well the company fosters new ideas and turns them into revenue.

Why does it matter?

Innovation keeps your business alive and future-proof.

Formula:

Revenue from New Products / Total Revenue

Human perspective:

If a company doesn’t innovate, it’s like driving a car with no map eventually, you’ll get lost.

No 15. Brand Equity

It’s the value people place on your brand how they trust it, recognize it, and feel about it.

Why does it matter?

A strong brand means customers come back, pay premium prices, and recommend you.

Formula:

Usually measured through surveys and brand loyalty indexes.

Human perspective:

Think of brands like Nike or Apple. Their products aren’t the cheapest but people buy them because they believe in them.

No 16. Market Expansion

Shows how successfully you grow into new markets or regions.

Why does it matter?

Diversifying your revenue streams reduces risk.

Formula:

Revenue from New Markets / Total Revenue

Human perspective:

If you sell lemonade on one street, but then expand to three streets, you spread your opportunities (and lower your risk if one location fails).

No 17. Sustainability Metrics

Tracks how well your business achieves environmental or social goals.

Why does it matter?

Customers and regulators increasingly demand greener, more responsible companies.

Formula:

Sustainability Goals Achieved / Total Sustainability Goals

Human perspective:

It’s like checking if you actually keep your promise to recycle at home. Talk is cheap metrics prove it.

No 18. Employee Engagement

Measures your team’s enthusiasm, commitment, and motivation.

Why does it matter?

Engaged employees are more productive, loyal, and creative.

Formula:

Typically measured through employee surveys and engagement scores.

Human perspective:

If you love your job, you do it better. Same goes for your team.

No 19. Employee Turnover

The rate at which employees leave the company.

Why does it matter?

High turnover is expensive, disruptive, and usually a sign of deeper cultural issues.

Formula:

(Number of Employees Left / Average Number of Employees) x 100

Human perspective:

If people keep quitting, something is broken. Fixing that saves you huge money and stress.

No 20. Cash Flow

The net movement of cash in and out of your business.

Why does it matter?

No cash? You’re out of the game, no matter how good your product is.

Formula:

Operating Cash + Investing Cash + Financing Cash

Human perspective:

Your personal budget works the same way: if your bills exceed your paycheck, you’re in trouble. A business is no different.

Conclusion:

Business isn’t just about chasing growth it’s about growing smart. These KPIs are your compass. You don’t need to track all 20 at once, but pick a few that matter most to your goals and start there.

Remember: Behind every metric is a real story, a customer, a team member, and your hard work. Let these KPIs guide you not control you.

FAQ’s

What is a KPI?

A KPI (Key Performance Indicator) is a key number that shows how well your business is doing.

How many KPIs should I track?

Focus on 5 to 10 that matter most to your goals quality over quantity!

Do KPIs change over time?

Yes! As your business grows, your KPIs should grow and evolve too.